Compare Singlife Flexi Life Income and its equivalent all at once

Make an informed decision. Get 5 different advisors to help you compare Singlife Flexi Life Income against other Endowment and see which one is best for you. Takes less than 5 minutes!

Really takes under 5mins!

1170+

Suggestions Facilitated

154+

MAS Licensed Advisors

Really takes under 5mins!

MAS approved advisors from

Why choose Whatins to help?

First thing's first. We are just like you - everyday people who find the insurance buying process confusing and hard to navigate.

We built this platform to make insurance easier. Our goal is to help you discover all your options so you can make an informed decision.

Unlike other sites, we are not associated with any company and are truly third party.

This means we have no incentive to push you to any one company or any one advisor.

You won't find any other site able to say this.

No fuss, no hassle

Advisors can not spam you as providing your phone number is optional and we do not share your contact until after they submit their suggestions. This allows you to take your time deciding on the right policies for you.

Multiple perspectives

By getting 5 different advisors to share their perspectives, you can properly compare your options instead and instantly identify the advisors who are trying to oversell you.

AI assisted analysis

5 perspectives can be a lot to process. That's why we built AI tools to help you analyse your options and support you all the way so you can be confident in your decision.

Why compare Singlife Flexi Life Income with other Endowment options through Whatins?

Traditional Approach

- Only see one company's projected returns

- May push higher projections without context

- Limited comparison of guaranteed amounts

Whatins Advantage

- Compare guaranteed returns across insurers

- See how different companies project returns

- Get multiple views on bonus rate histories

- Understand different payout structures

No Number Needed

No phone number needed. No endless calls. Just clear advice on your terms.

Why This Works Better

- No phone number sharing required

- Control the conversation - mute or unmute as needed

- Compare advice easily with chat history

- Zero pressure - chats disappear after 5 days

- Leave any chat instantly if you're not comfortable

Hear what others are saying

Lynn

Age 26

Phone number really isn't needed!

I loved that I didn't need to give out my phone number to get great advice. They created a telegram bot that connects the advisors to me so the advisors don't get my personal ID.

Jo

Age 43

It way okay

(Yeah we know)

Joseph

Age 35

Great experience

I have some underlying conditions and I was amazed at how the advisors were able to give me very helpful suggestions.

Amanda

Age 25

Would recommend

I appreciate this service because I can instantly see when an advisor tries to sell me things I don't need as their premiums are much higher than the rest.

Naterlie

Age 26

Easy & intuitive

Getting the insurance suggestions through Whatins is pretty easy and intuitive. I've actually recommended to others to give it a go if they want some recommended insurance plans.

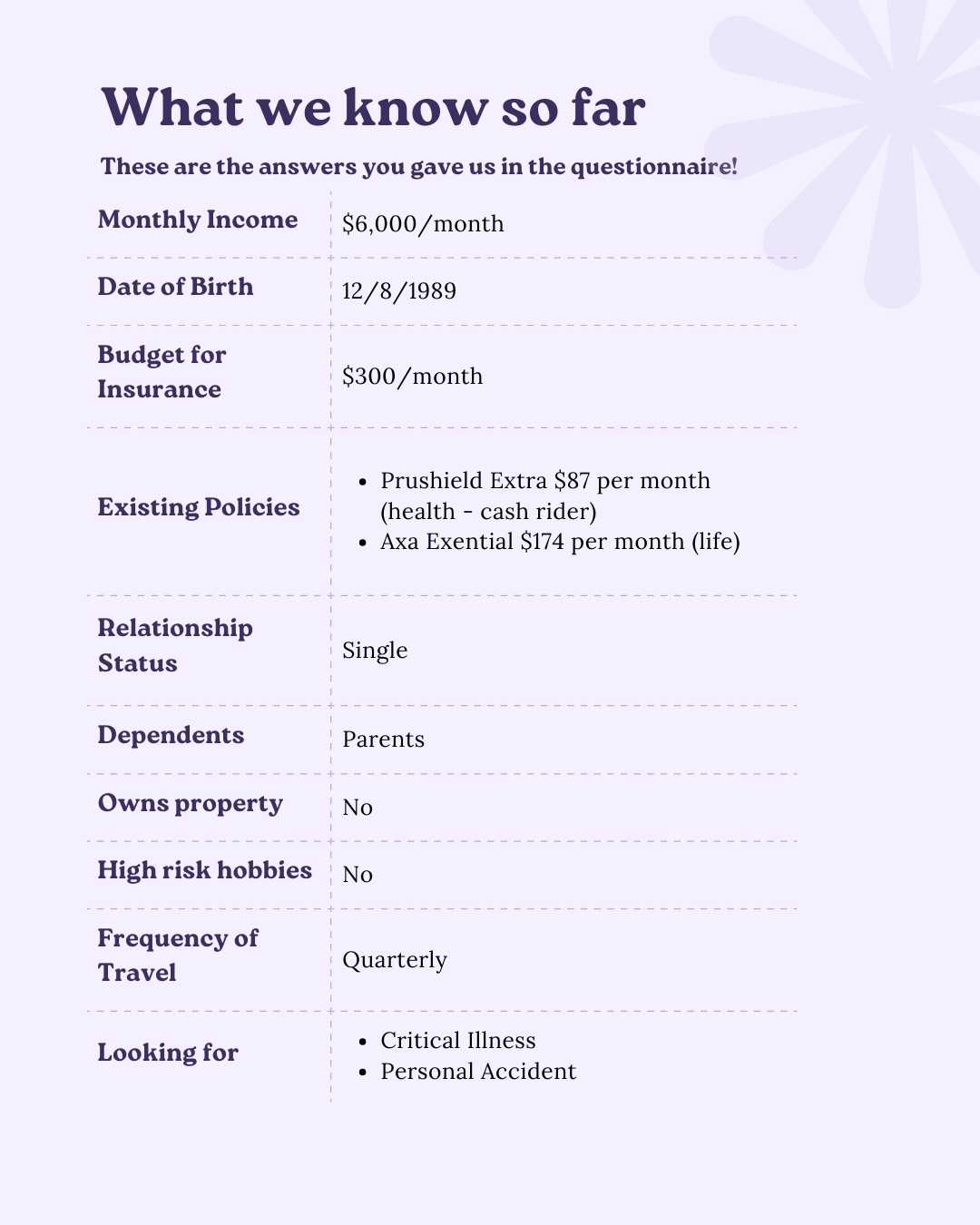

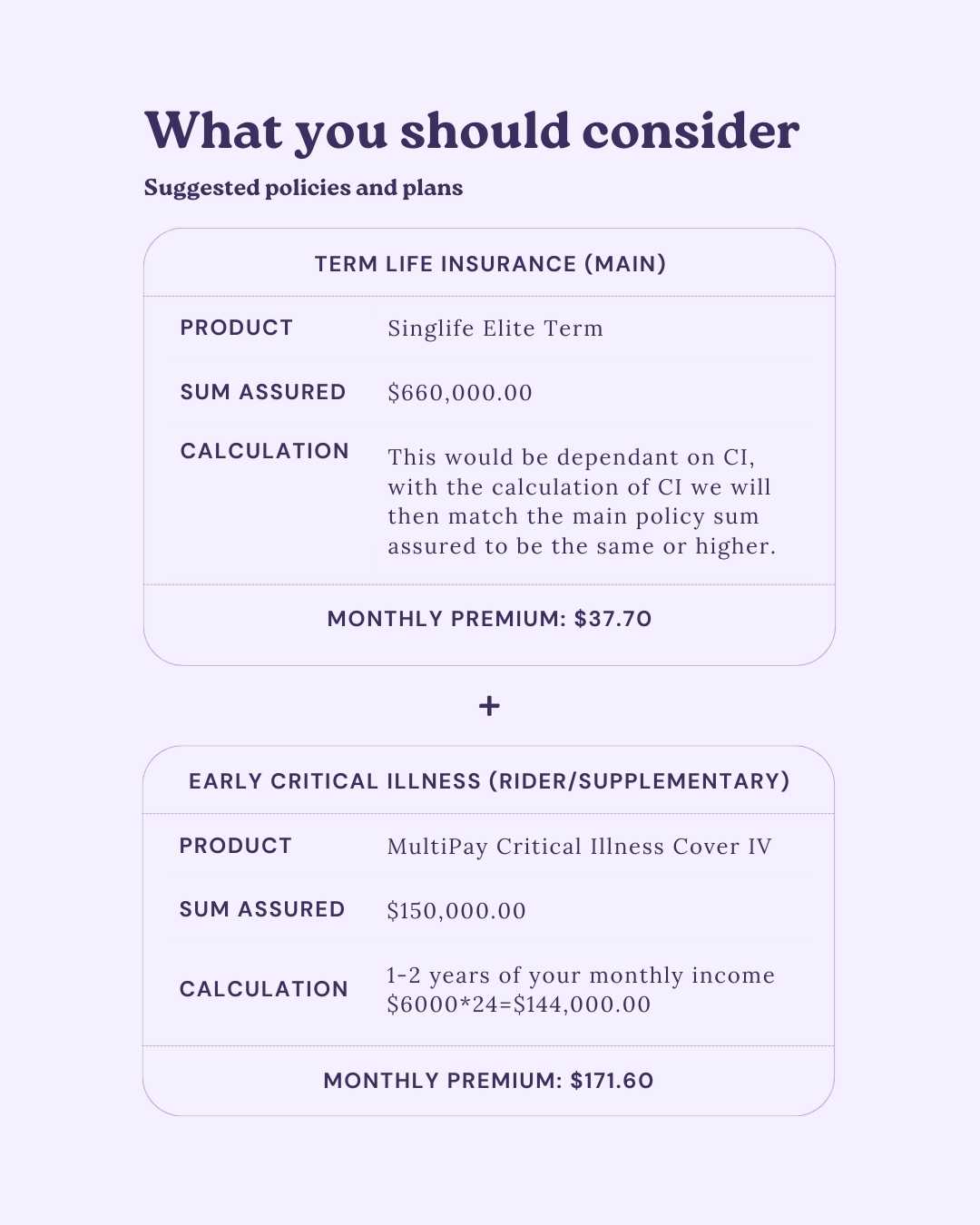

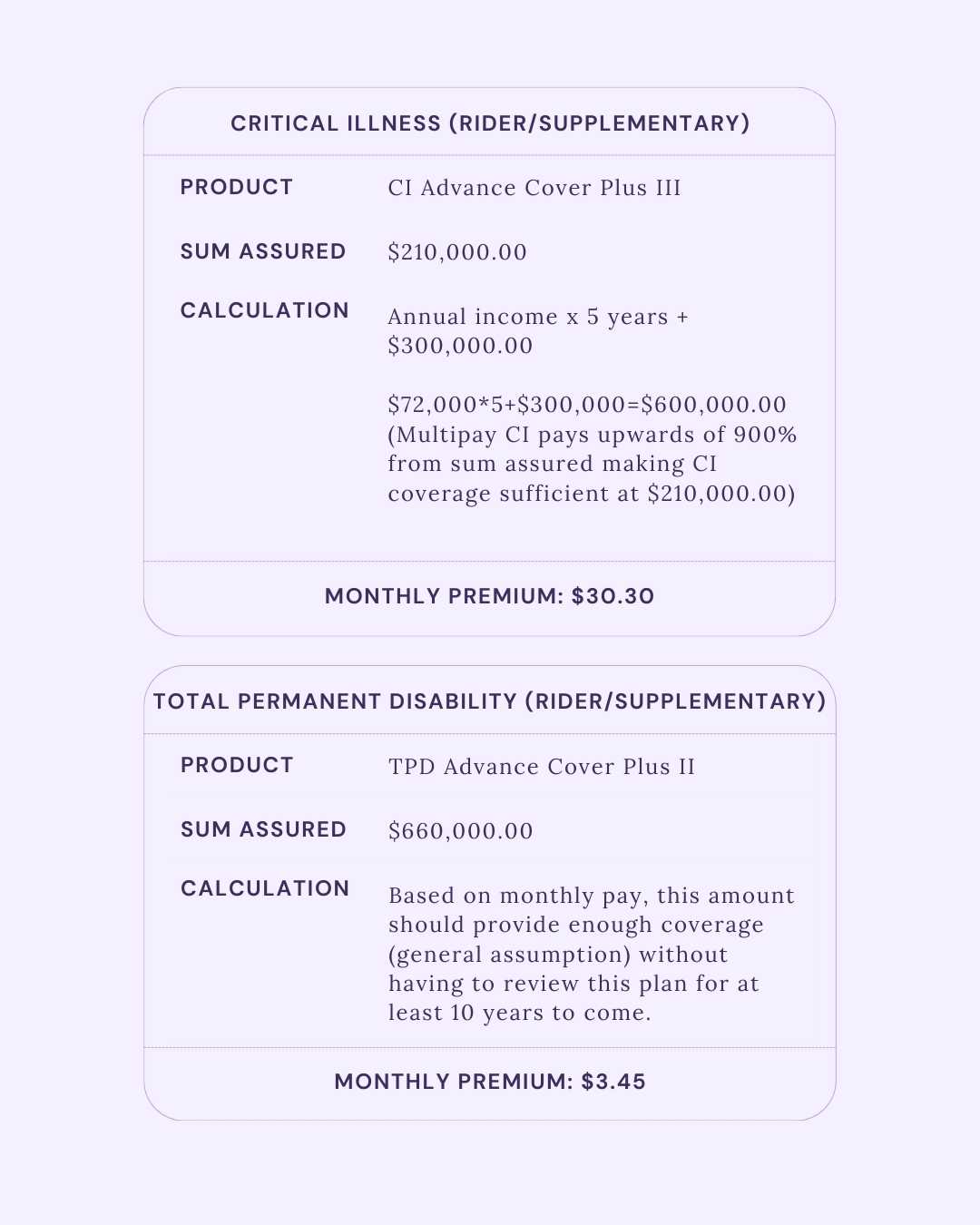

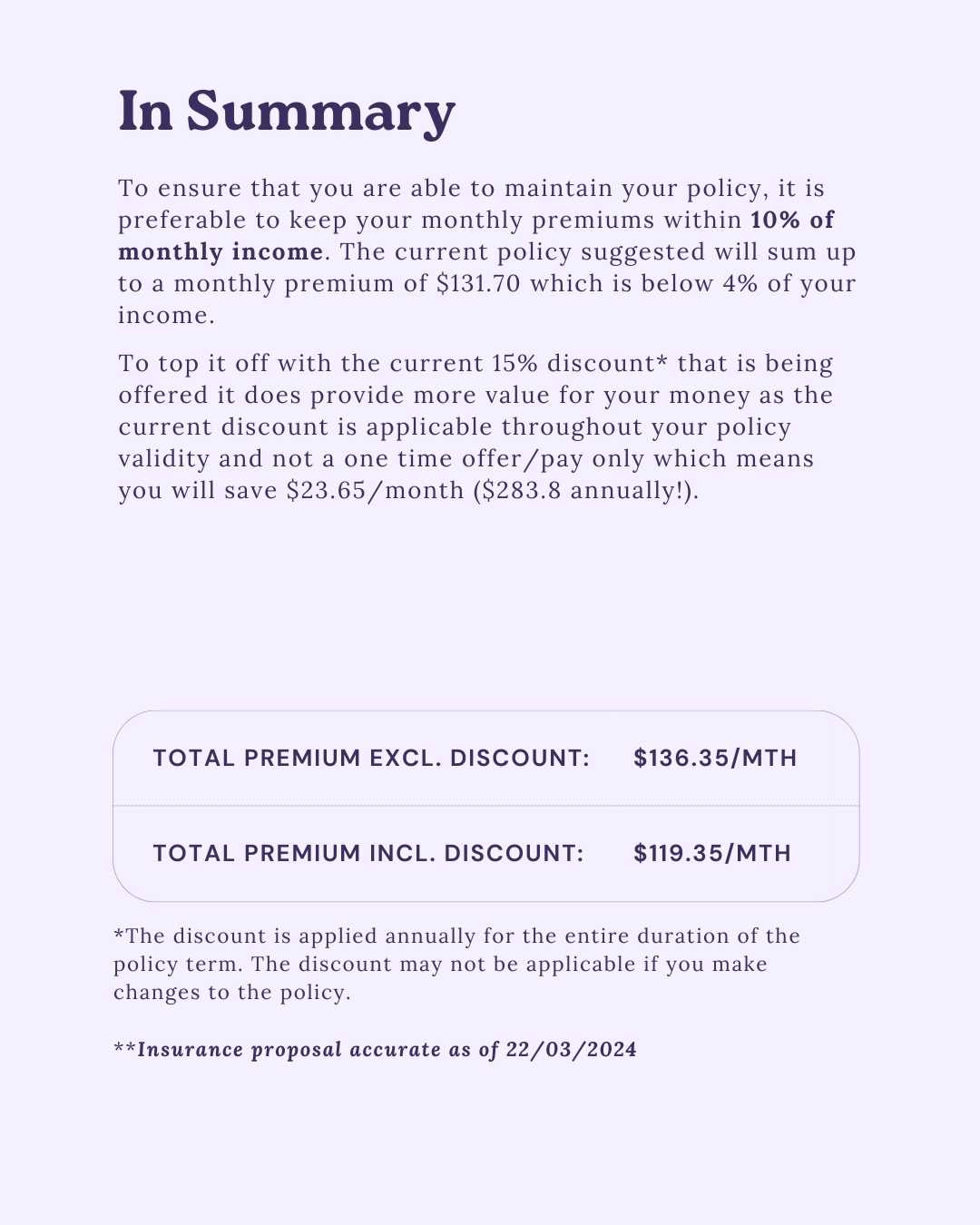

Sample Proposal

How it works

Step 1: Complete questionnaire

Answer a few simple questions about your current insurance situation and potential future needs.

Step 2: Get matched with 5 insurance advisors

The advisors are from different companies, giving you a wide range of perspectives.

Step 3: Get private Telegram consultations

Connect with advisors through private Telegram chats - no phone number needed. Chats automatically close after 5 days.

Step 4: Choose who to work with

After reviewing suggestions and having brief interactions, you decide who deserves your time for a full insurance analysis.

Why Telegram Works Better

- No phone number sharing required

- Control the conversation - mute or unmute as needed

- Compare advice easily with chat history

- Zero pressure - chats disappear after 5 days

- Leave any chat instantly if you're not comfortable

Compare Singlife Flexi Life Income and its equivalent all at once

Make an informed decision. Get 5 different advisors to help you compare Singlife Flexi Life Income against other Endowment and see which one is best for you. Takes less than 5 minutes!